ANDRES ROYO

UX/UI Product designer

Taxdown

The Goal

Analyze and study the flow of users when they have to declare their properties and propose solutions or improvements to retain users in this process.

Research

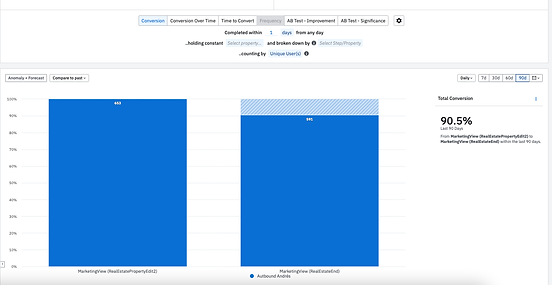

During my work at Taxdown, I was the project owner of the property flow improvement. This project arose due to the fact that throughout the current year's campaign, it was identified that many users left the flow when declaring their properties with specific characteristics, for which the biggest problems were identified to implement solutions and retain these users.

The research process began by analyzing the most common problems, creating funnels with certain characteristics and analyzing which are the biggests falls. In addition to that, interviews were conducted with users who were identified in the funnels that did not finish the process, and finally interview the different team leaders in the tax department to confirm and add to the problems identified and propose solutions before the end of the campaign.

Data

85%

of the users completed the flow of properties owning a parking garage

78%

of the users completed the flow of properties with specific uses

80%

of the users completed properly all the information regarding the cadastral value

Problems identified

After analyzing data requested from the data department about users who declare properties, interviews with users who didn't finish the process when declaring their properties, interviews with the tax department to get insights about the problems, and user testing the entire flow of properties these problems were identified.

01

Many of the property-related articles had a fairly low satisfaction rating

02

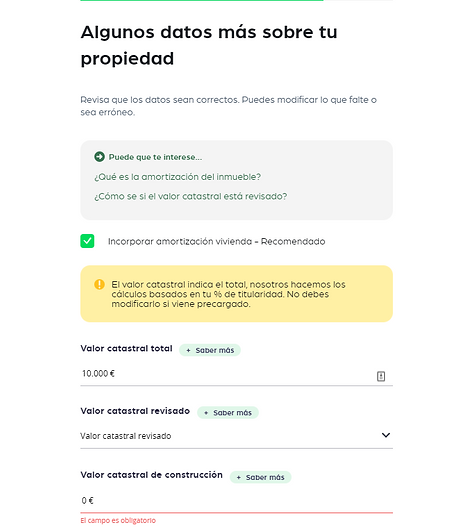

Many users changed the cadastral reference of their homes because they had an ownership percentage of less than 100% since they thought that it had to be equivalent to the ownership percentage, but they did not know that it was calculated proportionally to their ownership, which is why internally this had to be changed manually when filing the income tax return by the tax advisors.

03

.png)

When declaring parking garages, users were not very sure of the different characteristics and how to declare whether or not it was associated with the main home.

04

.png)

When users declared the different uses of their property, they got very confused with having to complete the 365 days and they were not always able to record all the uses correctly because sometimes the property was used for less than 365 days in that year.

Solutions

01

Recreate all articles that had a low satisfaction rate and with just 1 week the satisfaction rates were increasing slowly.

02

.png)

.png)

Implemented an informative banner on the screens related to the cadastral value in order to inform users that it is automatically calculated based on their percentage of ownership. Additionally, informed them not to edit the value if it comes preloaded from the Treasury.

03

.png)

.png)

Implemented an automatic bot that pops up on certain screens related to the registration of parking spaces so that users who are not sure about how to declare it know how to do it. I made the flow of the bot with the goal of be covering as much as possible about what is considered a parking garage and what is not in regards to being associated to a main house and not.

04

.png)

.png)

I created 2 explanatory videos where step by step I explain the uses that confused users the most. These uses are to complete the 365 days by adding vacancies when the property has less than 365 days of being used that year and other uses and vacation properties. This is displayed by spending about 30 seconds on the same screen throwing a lifeline to users who may be confused.